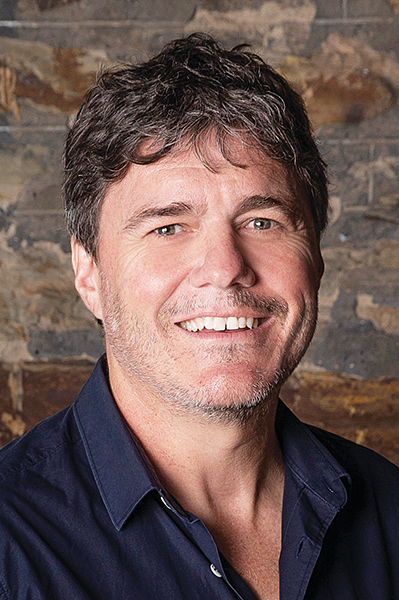

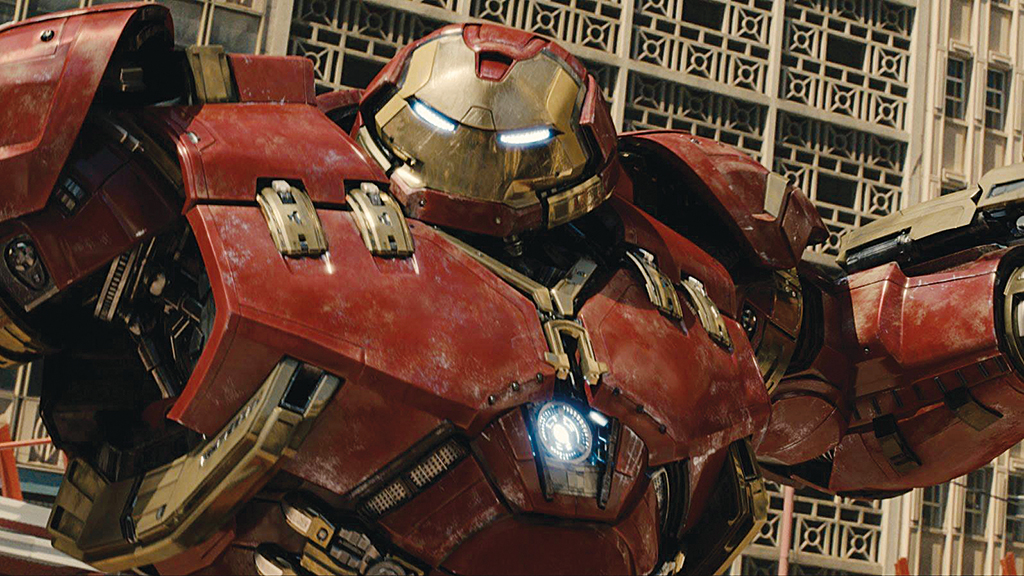

Artificial intelligence facial-capture helped detail Thanos’ facial features in Avengers: Infinity War (2018). (Image courtesy of Digital Domain)

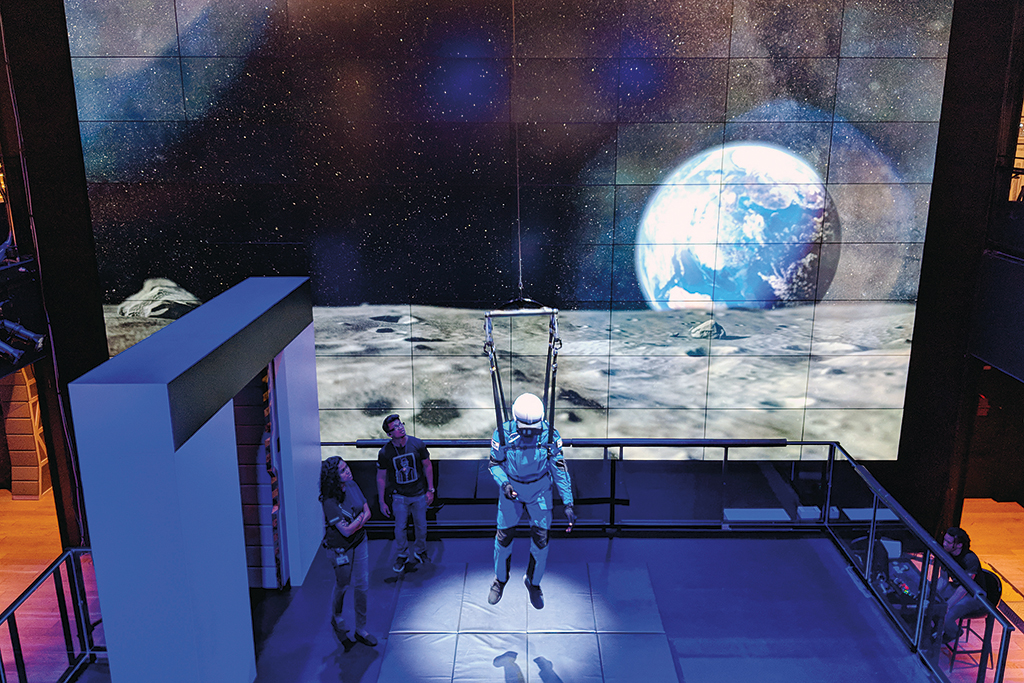

Behind the scenes on First Man (2018). (Image courtesy Universal Pictures and DNEG)

INTERSECTING FORCES

Parsing out today’s market is complex, as the forces of globalization, tax incentives, technology and workflow interact, both in terms of the industry and individual productions. Added to that are new platforms – especially streaming services – that increase opportunity, but also destabilize traditional models. Whether it’s Netflix, Amazon, YouTube, video games, virtual reality, augmented reality, theme parks or mobile content, the huge influx of content from new players and new platforms is a big factor behind today’s robust VFX market. Netflix especially has played a role in creating high-end streaming content in numerous regional markets worldwide, boosting local production, post and VFX markets.

“You have a whole new breed of client emerging,” says Ed Ulbrich, Method Studios President and GM. “There’s a paradigm shift. If you look at the landscape of major studios, you have to include Netflix, Apple and Amazon. Now you’re seeing Paramount producing movies for Netflix, which has no legacy studio infrastructure to preserve. All these companies are tech companies first, so they own massive cloud infrastructure or partner with each other to provide services.” Ali reports that Spin VFX has worked with Amazon and Netflix, saying the relationships have been good. “They have strong production teams that work very collaboratively with vendors,” she says.

At ILM in London, Executive in Charge Sue Lyster notes that the company is doing features for streaming, most recently working on Netflix’s Bird Box. “We’ve also hired a team of TV executives to build up the episodic TV side of the business,” she says. ILM London Creative Director Ben Morris notes that “the world of streaming does to a degree change how we work. If you have 1,000 shots in a film and 12 months to deliver, you stack up a lot of crew towards the end of delivery,” he says. “In episodic TV, you deliver a certain number of shots per month. There is no mad dash at the end, and you might get fewer iterations.” Rising Sun Pictures’ Clark also notes how the customers are changing. “We’re simultaneously seeing multiple new outlets with the streaming players and their demand for incredibly high quality on those platforms,” he says. “There’s been a little work for Netflix, and we’re keen to explore more in that space. A key part of our strategy is to facilitate top-end creative services for streaming platforms. We’ve invested significantly in being in the right shape to address those opportunities.”

At The Molecule in New York, Co-founder/Executive Producer Andrew Bly notes how OTT (Over the Top) services have changed the workflow – and the invoicing. “In the 2000s, the schedule was very predictable,” he says. “Now, with OTT services, seasons that used to be your downtime could be the busiest and vice versa. You can juggle all 10 episodes at once, and you have to think about how to invoice it. You’re on the hook to carry that money for a longer period. OTT services have also changed the quality. It used to be about doing the best job, but fast enough to hit the airwaves. Now, the Amazons and Hulus are all gunning for that high quality and viewers expect it. As a company you have to figure out how to keep an efficient pipeline to achieve feature-film quality.”

Framestore’s Managing Director of Integrated Advertising, Helen Stanley, describes how her company has been active in pioneering another new platform, virtual reality, beginning with a VR project in 2012 for Game of Thrones that was presented at the South By Southwest (SXSW) confab. “Since then, we’ve grown in that area,” she says. “We’ve started to work for major ride installations, for the main IP or agencies. Clients come to us with real-time requirements and the VR projects are becoming more and more ambitious.” One outlet is so-called dark rides, in which stereoscopic media is projected on to a huge screen, a very immersive replacement for animatronics. To accommodate this genre of work, Framestore has pulled project management and creatives into one team. “It’s adding a new category for the visual effects facility,” says Stanley. “We combine the creative people with those who are experts in rides, and by end of April we’ll have created a ride in every type of genre, including VR walk-through, riding and motion-based. We’ve done brand-based rides for Samsung and VW in China, and gravity-free experiences where we partnered with hardware manufacturers and worked like a digital production company for the agency.”

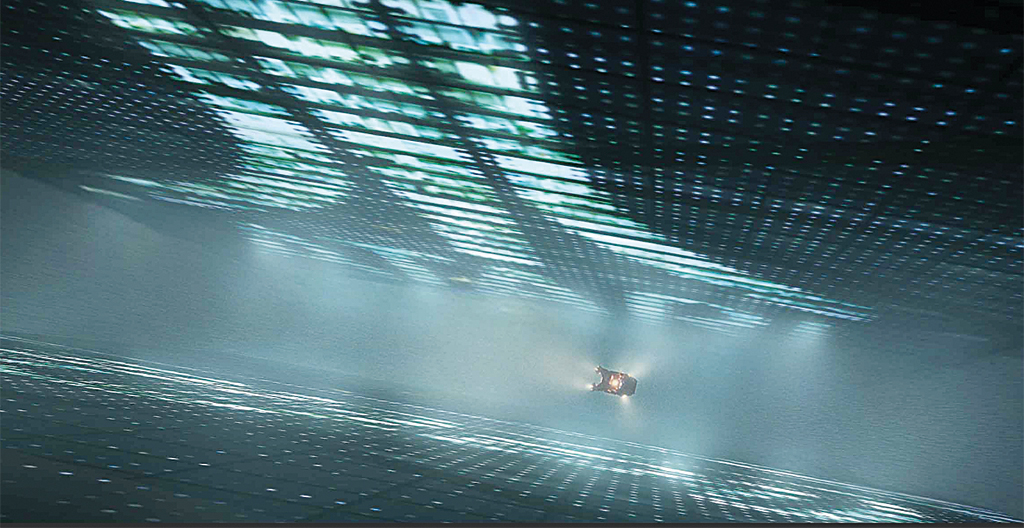

The moving cities of Mortal Engines (2018). (Image courtesy of Universal Pictures)

War for the Planet of the Apes (2017). (Image courtesy of Twentieth Century Fox)

TAX INCENTIVES

While new platforms and outlets provide for a growing regional market and stretch traditional digital VFX houses into new genres, tax incentives are responsible for sending productions – and often post and VFX – to far-flung destinations, from Atlanta to Montreal, London to Berlin – to enjoy rebates. “Vancouver was the granddaddy of all of them, and has been very successful,” says Chambers. “But look what’s happened in places like Michigan – they threw big tax incentives out there and used old warehouses for stages, and the producers said yes, but they didn’t have the crew base to support the work.” For that reason, although Atlanta is one of the destinations that has benefited from incentives, many other U.S. states that initially offered them have taken stock of the fact that tax incentives were not a short-term fix to create a new industry sector.

“The way producers are using tax incentives has changed,” says Visual Effects Supervisor Jeffrey A. Okun, VES. “The spend has to be correct and it has to go to the right company and be the right incentive. A VFX producer’s job has become really complicated. My job is more fun. It’s easy to find creative talent because I have a huge pool to pull from – the entire world! What’s important to note is that if most of the incentive companies were put up against the U.S. companies, the U.S. companies are actually cheaper.”

In London, ILM’s Lyster points out that the film tax break “isn’t there to support visual effects, but the growth and well-being of the British film industry. Still, there’s no doubt in many ways it plays a part in the growth of the VFX industry in London,” she says. “There’s a symbiosis. In a place like Montreal, where they have a very healthy tax break, the challenge has been finding and building the talent. I don’t think ILM would have come to London if there had been a tax break but no talent to hire. The two go hand in hand.”

At Framestore, Managing Director of Feature Films Fiona Walkinshaw talks about the decision to open a Montreal facility in 2013. “There are big commitments from the government to maintain healthy incentives there,” she says. “We wouldn’t go into these places without knowing it’s a robust set-up. Incentives attracts a huge number of artists to Montreal, and so many people paying taxes is good for their economy and the other businesses they’re trying to build up.” In Toronto, Ali reports that most of Spin VFX’s work comes from the U.S. “We’ve spent the past 15 years developing relationships locally and internationally,” she says. “Incentives are quite attractive, and many U.S. companies want to shoot in Canada, which creates a great opportunity to complete VFX here.” At the same time, she notes, “many jurisdictions have similar incentives, which has resulted in greater competition within the industry.”

Australia also has competitive incentives, says Clark, with a 30% federal rebate on qualifying gross spend, with various state incentives that can be added on top. “They’re all simple and predictable,” he says. “In Rising Sun Pictures’ home base of South Australia, they can be combined to create a 40% rebate pretty much on all VFX spend – and as high as 50% on an Australian project.” In India, BotVFX Chief Executive/Co-founder Hitesh Shah notes that, although the city of Chennai has incentives, he considers incentives as “a fickle thing. The dynamics of incentives create friction in global decision making,” he says. “The accountants get into the number crunching to see where it needs to be and everyone has to work around those targets, even if it’s suboptimal in other ways.”